42 how to calculate coupon rate from yield

What Is Coupon Rate and How Do You Calculate It? Coupon and yield rates are: Coupon Rate: 10%. This does not change. Investor A Yield Rate: 9%. The investor paid $1,100 for a bond that returns only $100 per year, making their yield on the bond lower than its coupon rate. Investor B Yield Rate: 11%. The investor got a good deal on this bond, collecting $100 per year in exchange for a $900 ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years.

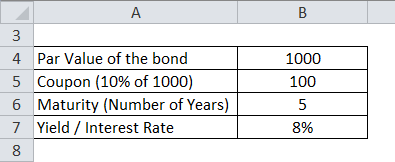

Bond Yield Formula | Step by Step Calculation & Examples Annual Coupon Payment = Face Value * Coupon Rate =$1300*6% Annual Coupon Payment =$78 Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875%

How to calculate coupon rate from yield

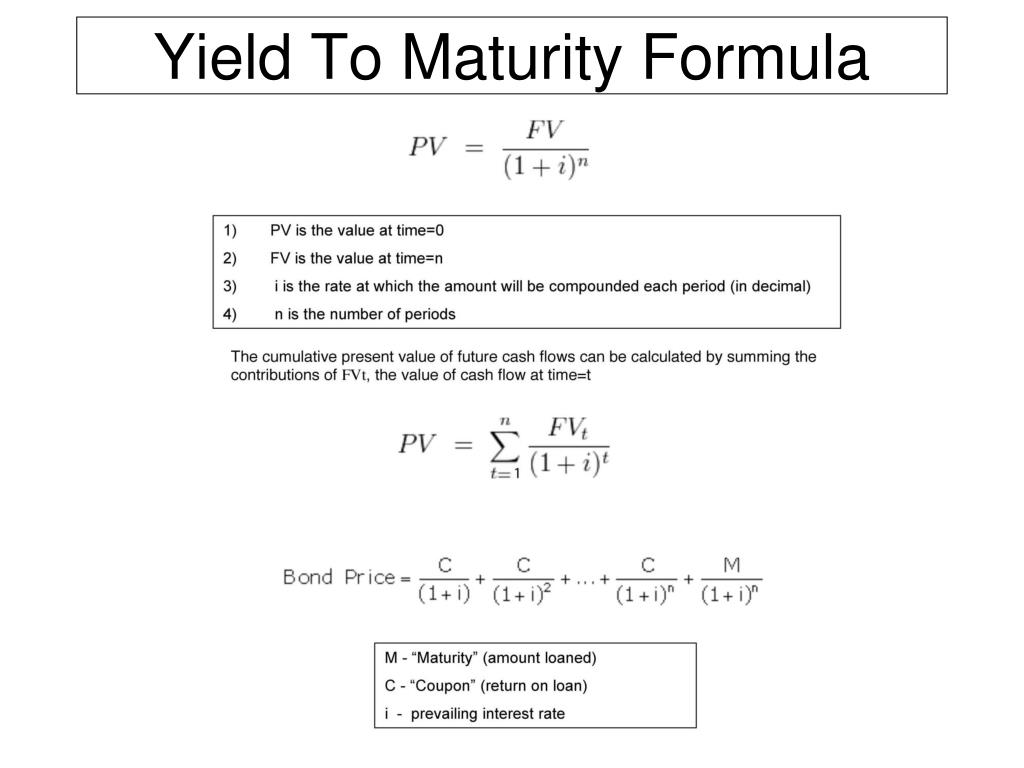

How to Calculate Current Yield (Formula and Examples ... Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100 Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value. Calculating Yield to Maturity and Current Yield PV = ($1,050) PMT = $65 ($1,000 par x 6.5% annual coupon) FV = $1,000 i or YTM = 5.3344 or 5.3344% The Current Yield is 6.19%, here's how to calculate: ($65 coupon / $1,050 current price). Now consider that there is another 5-year bond with the same credit rating and a 5.75% annual coupon selling for $928.92.

How to calculate coupon rate from yield. Effective Yield - Overview, Formula, Example, and Bond ... Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year. Bond Yield Formula | Calculator (Example with Excel Template) Coupon Payment = Coupon Rate * Par Value Coupon Payment = 5% * $1,000 Coupon Payment = $50.0 Current Yield is calculated using the formula given below Current Yield = Coupon Payment / Current Market Price * 100% For Current Market Price (Premium) Current Market Price = $50 / $1,020 * 100% Current Market Price = 4.9% For Current Market Price (Par) How to Calculate Yield to Maturity: 9 Steps (with Pictures) Plug values between 6 and 7 percent into the formula. Start with 6.9 percent, and decrease the annual interest rate amount by a tenth of a percent each time. This will give you a precise calculation of the yield to maturity. For example, when you plug in 6.9 percent (3.45 percent semi-annual), you get a P of 95.70. Coupon Rate: Formula and Bond Nominal Yield Calculator Lastly, the coupon rate is calculated by dividing the annual coupon payment by the face (par) value of the bond – which must be multiplied by 100%. Fixed vs ...

non callable bond calculator V +Δy - The bond's value if the yield rises by a certain percentage; V 0 - The present value of cash flows (i.e. pay off the debt earlier. Using our YTC calculator, enter: "1,000" as the face value "8" as the annual coupon rate "5" as the years to call "2" as the coupon payments per year "103" as the call premium, and "900" as the current bond price. Bond Yield Calculator - Compute the Current Yield The current yield of a bond is the annual payout of a bond divided by its current trading price. That is, you sum up all coupon payments over one year and divide by what a bond is paying today. Bond Current Yield vs. Yield to Maturity Calculating Yield to Maturity of a Zero-Coupon Bond Find out how to calculate the yield to maturity of a zero-coupon bond, and learn why this calculation is simpler than one with a bond that has a coupon. Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Current Yield vs. Yield to Maturity - Investopedia Bond Yield as Function of Price — The current yield of a bond is calculated by dividing the annual coupon payment by the bond's current market value. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of the bond. for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Current Yield Formula | Calculator (Examples with Excel ... Current Yield of a Bond can be calculated using the formula given below Current Yield = Annual Coupon Payment / Current Market Price of Bond Current Yield = $60 / $1,010 Current Yield = 5.94% Therefore, the current yield of the bond is 5.94%. Current Yield Formula - Example #3

Yield to Maturity (YTM) - Investopedia Y T M = Face Value Current Price n − 1 · where: · n = number of years to maturity · Face value = bond's maturity value or par value · Current ...

How to Calculate Coupon Rates - sapling The coupon rate is always based on the bond's face value, but you use the purchase price of the bond to figure the current yield. The formula for the current yield is the annual coupon payment divided by the purchase price. Advertisement For example, suppose you purchased from a bond broker a $1,000 face-value bond with a $40 annual coupon or $970.

Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

How to Calculate the Yield of a Zero Coupon Bond Using ... So let's go ahead and start plugging in so we see here we have (1 + the forward rate) from year 1 so that's 7% so that's same as 0.07 so we'd have ( 1 + 0.07) is going to be that first term. So We have 1.07. So we're gonna multiply 1.07 by the next term (1 + the forward rate) rate for year two. What's the forward rate for year two? It's 6.8%.

Bond Yield Definition - Investopedia If a bond has a face value of $1,000 and made interest or coupon payments of $100 per year, then its coupon rate is 10% ($100 / $1,000 = 10%). However, ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Yield to Maturity (YTM): Formula and Excel Calculator Coupon Rate (C): Often referred to as the bond's interest rate, the coupon rate is the periodic payments made regularly from the bond issuer to the investors - in general, the higher the coupon rate attached to the bond, the higher the yield, all else being equal.

Coupon Rate and Yield to Maturity | How to Calculate ... The coupon rate represents the actual amount of interest earned by the bondholder annually while the yield to maturity is the estimated total rate of return ...

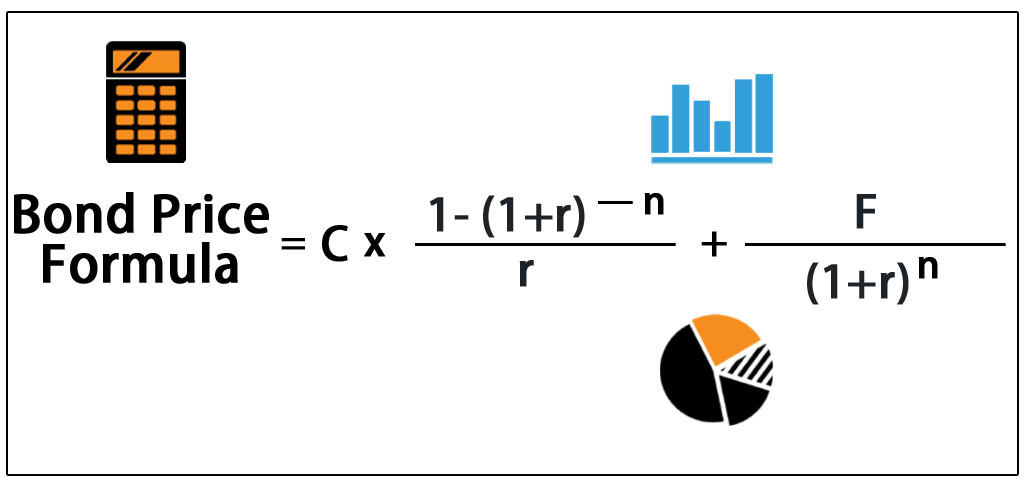

Coupon Rate Formula - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

When is a bond's coupon rate and yield to maturity the same? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 ...

Yield to Maturity Calculator | Calculate YTM In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a coupon rate of 5% and an annual frequency. This means that the bond will pay $1,000 * 5% = $50 as interest each year. Determine the years to maturity; The n is the number of years from now until the bond ...

Calculating Yield to Maturity and Current Yield PV = ($1,050) PMT = $65 ($1,000 par x 6.5% annual coupon) FV = $1,000 i or YTM = 5.3344 or 5.3344% The Current Yield is 6.19%, here's how to calculate: ($65 coupon / $1,050 current price). Now consider that there is another 5-year bond with the same credit rating and a 5.75% annual coupon selling for $928.92.

Coupon Rate Definition - Investopedia A coupon rate is the yield paid by a fixed income security, which is the annual coupon payments divided by the bond's face or par value.

How to Calculate Current Yield (Formula and Examples ... Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100

![Calculate fixed amount before tax calculation [#1612662] | Drupal.org](https://www.drupal.org/files/coupon_dist.jpg)

Post a Comment for "42 how to calculate coupon rate from yield"