39 bond coupon interest rate

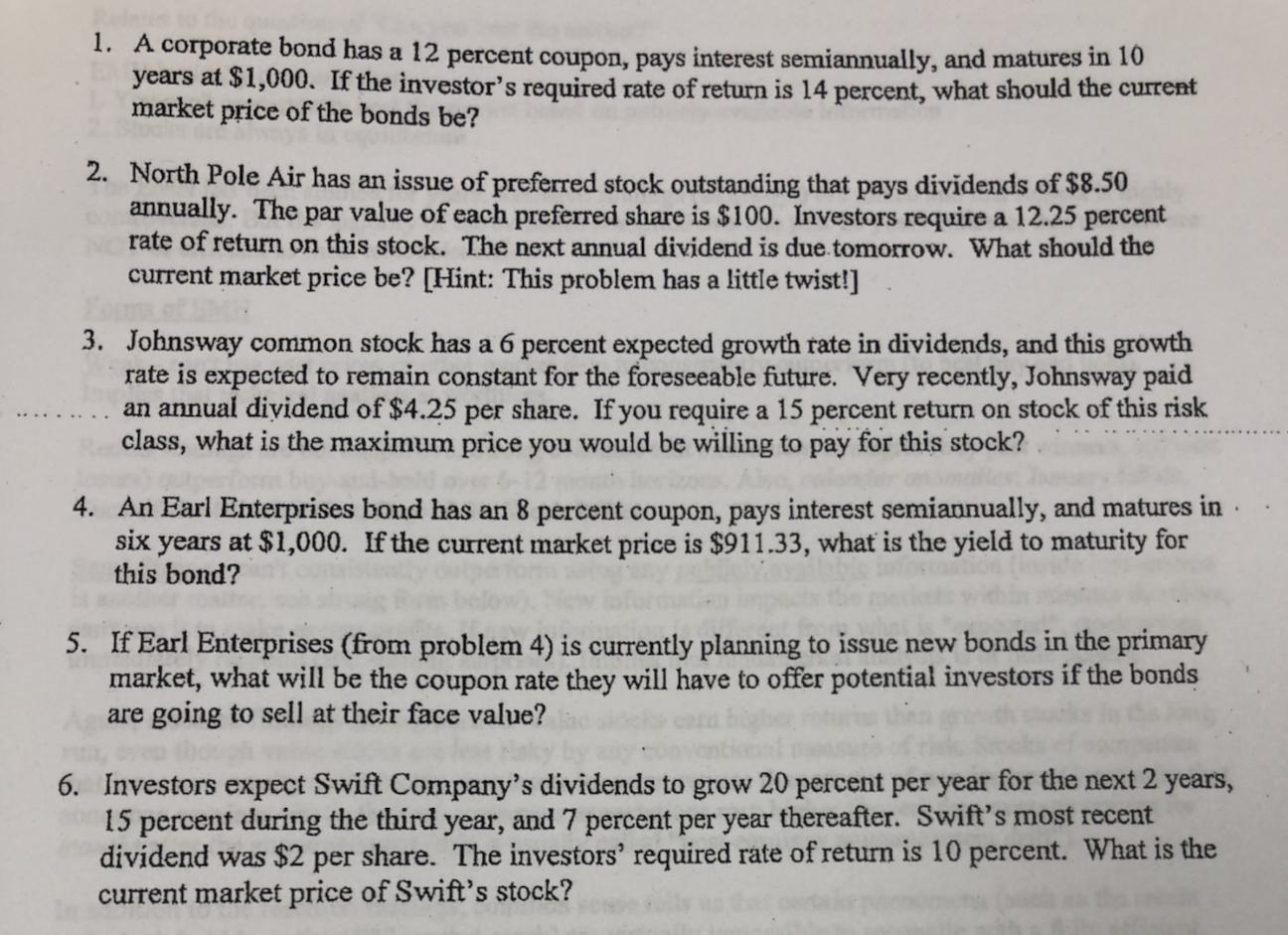

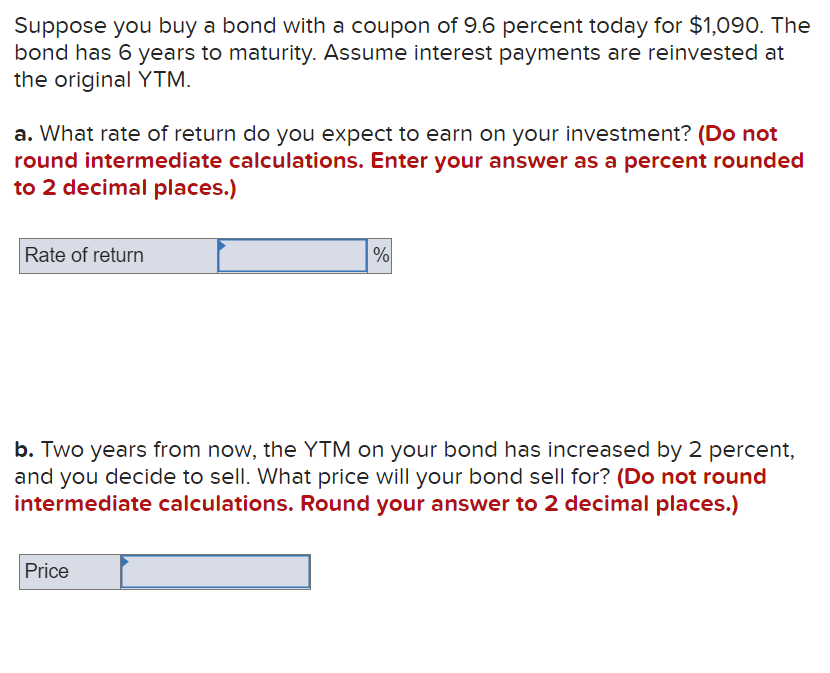

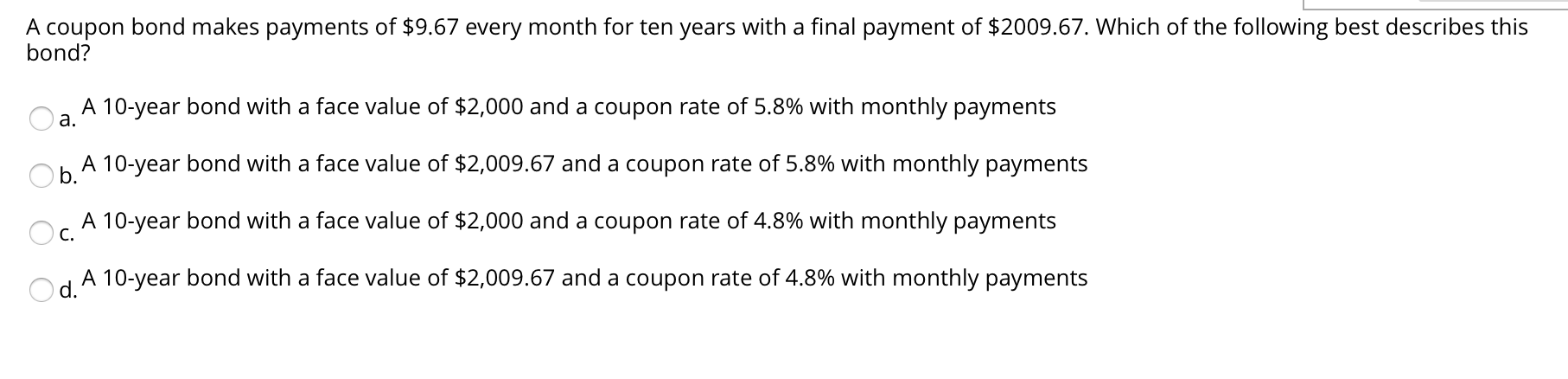

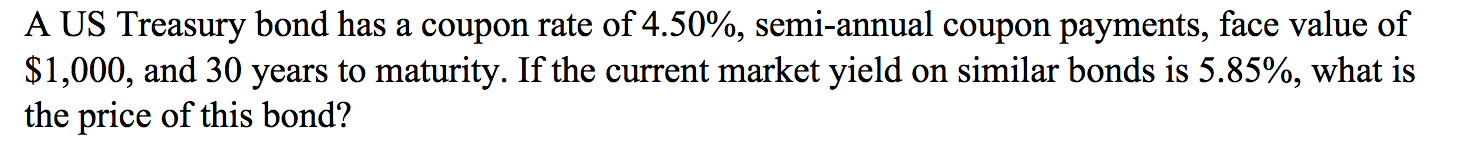

Coupon Interest and Yield for eTBs | australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. These instalments are called Coupon Interest Payments. Coupon Rate Calculator | Bond Coupon 15.07.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to help you …

How Is the Interest Rate on a Treasury Bond Determined? 29.08.2022 · Interest Rate Vs. Coupon Rate Vs. Current Yield . T-bonds don't carry an interest rate as a certificate of deposit (CDs) would. Instead, …

Bond coupon interest rate

Bond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. The average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am. How to Calculate an Interest Payment on a Bond: 8 Steps 10.12.2021 · To calculate the interest payment on a bond, look at the bond’s face value and the coupon rate, or interest rate, at the time it was issued. The coupon rate may also be called the face, nominal, or contractual interest rate. Multiply the bond’s face value by the coupon interest rate to get the annual interest paid. If the interest is paid ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations.

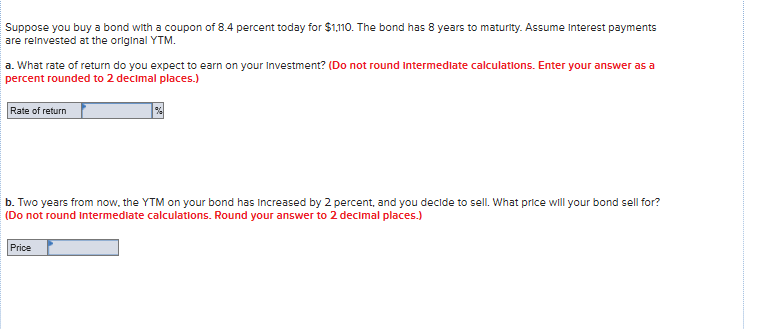

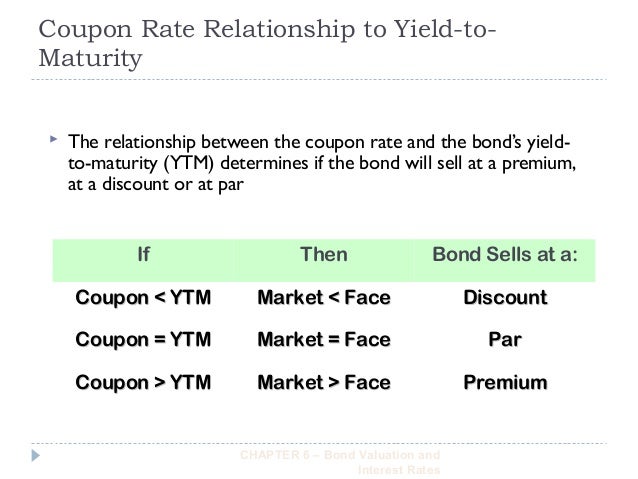

Bond coupon interest rate. Relationship Between Interest Rates & Bond Prices - Investopedia 16.05.2022 · Conversely, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, resulting in a decline in its price. Zero-coupon bonds provide a clear example of ... What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · If prevailing interest rates on other similar bonds rise, pushing down the price of the bond in the secondary market, the amount of interest paid remains at the coupon rate based on the bond’s par value. The same will occur if interest rates drop, pushing the price of the bond higher in the secondary market. Government to pay 29.8% interest rate on 3-year bond 25.07.2022 · The coupon rate was 6%, lower than the initial pricing guidance of 7.25%. The last time government issued a three year bond, it agreed to pay 25% interest. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Thus Cube Bank will pay $463.19 and will receive $1000 at the end of 10 years, i.e., on the maturity of the Zero Coupon Bond, thereby earning an effective yield Effective Yield Effective yield is a yearly rate of return at a periodic interest rate proclaimed to be one of the effective measures of an equity holder's return as it takes compounding into its due consideration, unlike …

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Also, the issuer’s creditworthiness drives the coupon rate of a bond, i.e., a company rated “B” or below by any of the top rating agencies is likely to offer a higher coupon rate than the prevailing market interest rate to counterbalance the additional credit risk Credit Risk Credit risk is the probability of a loss owing to the borrower's failure to repay the loan or meet debt obligations. How to Calculate an Interest Payment on a Bond: 8 Steps 10.12.2021 · To calculate the interest payment on a bond, look at the bond’s face value and the coupon rate, or interest rate, at the time it was issued. The coupon rate may also be called the face, nominal, or contractual interest rate. Multiply the bond’s face value by the coupon interest rate to get the annual interest paid. If the interest is paid ... Bond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. The average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am.

Post a Comment for "39 bond coupon interest rate"