39 coupon rate bond calculator

Treasury Bonds Rates - WealthTrust Securities Limited Unlike a T-Bill, the holder of a T-Bond will be entitled to semi-annual periodic interest payments (coupon interest) which are paid at a predetermined fixed rate and a date during the life of the T-Bond. Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 ... Calculating Tax Equivalent Yield on Municipal Bonds - The Balance Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06.

Coupon rate bond calculator

Coupon Rate Calculator | Bond Coupon 15.07.2022 · With this coupon rate calculator, we aim to help you to calculate the coupon rate of your bond investment based on the coupon payment of the bond.Coupons are one of your two main sources of income when investing in bonds. Thus, it is essential to understand this concept before you dabble in the bond investment world.. We have prepared this article to … Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing August 8th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ...

Coupon rate bond calculator. Bond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Interest is compounded semi ... Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... This TIPS had an originating auction in February, where it got a real yield of 0.195% and a coupon rate of 0.125%. Thursday's auction demonstrates how much real yields have surged higher in 2022. ... I used TreasuryDirect's Savings Bond Calculator to get the current value of a $10,000 I Bond issued in March 2021. Because the calculator is ... Quant Bonds - Between Coupon Dates - BetterSolutions.com Price Between Coupon Dates You can calculate the price of a bond for dates between coupon dates by 1) Using the PRICE function. 2) Using the YIELD function - uses clean price as an argument SS What is the Clean Price ? Also known as the Flat Price, Quoted Price This is the price excluding any accrued income Traders usually quote clean prices

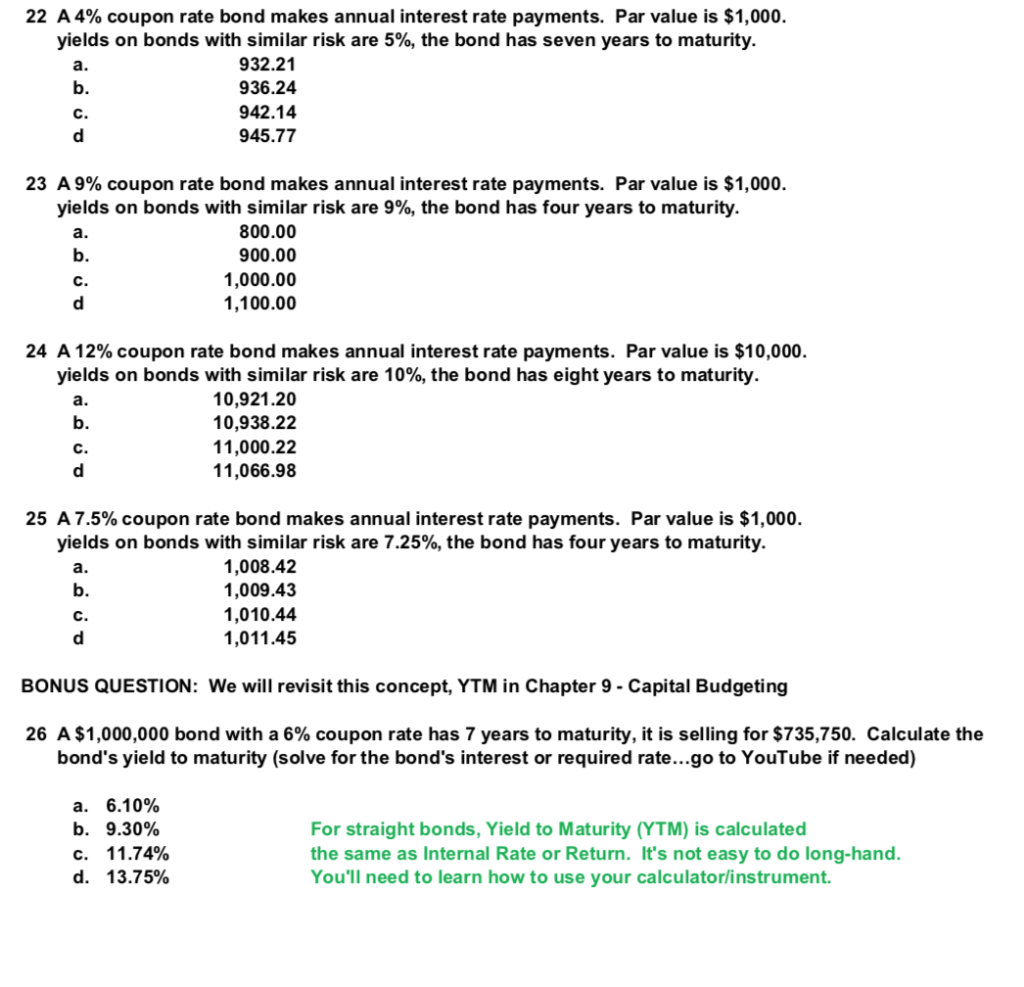

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision The coupon is calculated by multiplying the coupon rate by the par value (also known as face value) of the bond. The par value of a bond is the amount that the issuer agrees to repay to the bondholder at the time of maturity of the bond. In formula it can be written as follows: Coupon = Coupon Rate X Par Value How To Calculate YTM (Years To Maturity) On A Financial Calculator Enter the bond's coupon rate. This is the interest rate that the bond pays. Enter the number of years until the bond matures. Press the 'Calculate' button. The calculator will now give you the YTM, or years to maturity, for the bond. Keep in mind that this is only an estimate, as actual YTM can vary depending on market conditions. Understanding Bond Yield and Return | FINRA.org Yield to maturity (YTM) is the overall interest rate earned by an investor who buys a bond at the market price and holds it until maturity. Mathematically, it is the discount rate at which the sum of all future cash flows (from coupons and principal repayment) equals the price of the bond. YTM is often quoted in terms of an annual rate and may ... › calculate › bondBond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency.

How to Find Coupon Rate of a Bond on Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid Coupon Rate Formula & Calculation - Study.com To calculate the coupon rate of ABZ, the steps discussed in the coupon rate formula should be followed. Identify the par value of the bond: In this example, ABZ is issuing bonds with a $1,000 par ... Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity How to Calculate Bond Price in Excel (4 Simple Ways) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5. After executing the respective formulas, you can find different bond prices as depicted in the latter screenshot. The bond prices are in minus amount indicating present cash outflow or expenditure.

Zero Coupon Bond Calculator - Calculator Academy Enter the face value, bond yield rate, and time to maturity into the calculator to determine the zero-coupon bond. Maturity Gap Calculator PVBP - Price Value Basis Point Calculator Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value

Coupon Rate Definition - Investopedia 28.05.2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

If Interest Rates Rise, What Happens to Bond Prices? The bond's coupon payment is the amount the bond pays in a year. That amount divided by the bond's market price determines the yield. Thus, bond yield is calculated as: Bond yield = Annual coupon payment / Bond price. Hence, if bond prices change, so do bond rates, and thus, yields. For example, suppose you have a $500 bond with an annual ...

Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond.

Zero Coupon Bond Value - Formula (with Calculator) - finance … After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. In this example, we suppose that ...

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Below are the steps to calculate the Coupon Rate of a bond: Step 1: In the first step, the amount required to be raised through bonds is decided by the company, then based on the target investors (i.e. retail or institutional or both) and other parameters face value or par value is determined as a result of which, we get to know the number of bonds that will be issued.

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas.

How to Calculate the Bond Price using Python - Exploring Finance For example, let's suppose that you have a bond, where the: Coupon rate is 6% with semiannually payments; Yield to maturity (YTM) is 8%; Bond matures in 9 years; Bond's Face Value is 1000; What is the price of the Bond? Since we are dealing with semiannually payments each year, then the number of payments per period (i.e., per year) is 2.

Bond Yield to Maturity (YTM) Calculator - DQYDJ Annual Coupon Rate: 10%; Coupon Frequency: 2x a Year; 100 + ( ( 1000 - 920 ) / 10) / ( 1000 + 920 ) / 2 = 100 + 8 / 960 = 11.25%. What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find that answer? We calculated the rate an investor would earn reinvesting every coupon …

Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button.

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder.

Quant Bonds - Between Coupon Dates - BetterSolutions.com Quant Bonds - Between Coupon Dates Yield Between Coupon Dates There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function 4) Using the Secant Method 5) Using the Bisection Method 6) Using the Newton Raphson Assumptions

Treasury Bonds | CBK Treasury Bond Results. AUGUST 2022 FXD1-2022-003, FXD2-2019-010 AND FXD1-2021-20 DATED 22-AUG 2022.. Please note that calculators are provided to serve as guides for investors, but all final pricing is determined by the Central Bank. This calculator allows you determine what your payment would be based on the bond's face value, coupon rate ...

› terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Post a Comment for "39 coupon rate bond calculator"