42 irs quarterly payment coupon

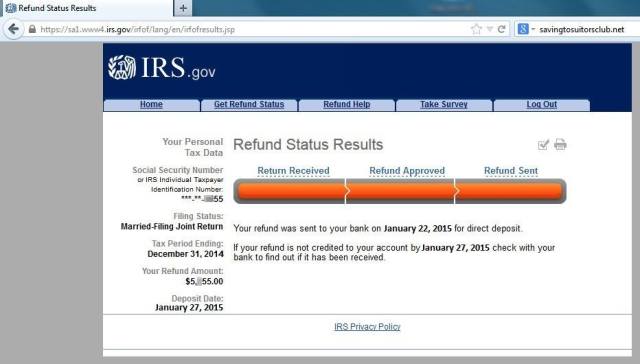

› payPayments | Internal Revenue Service - IRS tax forms May 28, 2022 · View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Failure To Deposit: IRS 941 Late Payment Penalties 10/09/2019 · Businesses file Employer's Quarterly Federal Tax Return paid after a month of each quarter. Here's what you need to know about 941 late payment penalty. ... 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty)

September 2022 - Department of Revenue - Kentucky September 20. Alcohol Tax. Cigarette Wholesaler. Coal Severance Tax Return (August payment) Consumer Use Tax. Emergency 911 Fee. Health Care Provider Tax. Insurance Premium Surcharge. Oil Production Tax Return (August payment)

Irs quarterly payment coupon

Payment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ... File IRS Form 2290 Online for 2022-23 | Schedule 1 in Minutes A. The following information is required for 2290 online filing. It is easy to follow the form 2290 instructions with e file form 2290 filing. You must keep the below 4 key details with you during form to 2290 e-file. EIN - This is a 9-digit Employee Identification Number. Business Name - You can find both Business Name and EIN on the SS-4 ... Selling Stock: How Capital Gains are Taxed - The Motley Fool Cost basis = $100 (10 shares @ $10 each) + $10 (purchase and sale fees @ $5 each) = $110Profits = $150-$110 = $40. So, in this example, you'd pay taxes on the $40 in profits, not the entire $150 ...

Irs quarterly payment coupon. 2021 IRS Form 940: Simple Instructions + PDF Download | OnPay Enter the total amount of payments made to all employees on this line 4. Enter any payments exempt from FUTA tax, checking the corresponding boxes for exemptions such as fringe benefits, group-term life insurance, retirement and pension, and dependent care 5. Enter the total amount of payments made to employees in excess of $7,000 6. Penalty for Not Paying Payroll Taxes | Consequences, Tips, & More 16+ days. 10%. 10+ days after first IRS bill. 15%. Let's say you are responsible for depositing $2,500 in payroll taxes to the IRS. You are 16 days late. The IRS would charge you a penalty of $250, meaning you would owe $2,750 in total. Keep in mind that this does not include any state penalties you might be obligated to pay. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms use Form 1040-ES to make this payment. Instead, make this payment separate from other payments and apply the payment to the 2020 tax year where the payment was deferred. You can use Direct Pay, available only on IRS.gov, to make the payment. Select the "balance due" reason for payment or, if paying with a debit or credit card, proconnect.intuit.com › articles › federal-irsIRS Federal Tax Underpayment Penalty & Interest Rates | Intuit IRS interest rates will remain unchanged for the calendar quarter beginning April 1, 2021. The rates will be: 3% for overpayments (2% in the case of a corporation); 3% for underpayments; and; 5% for large corporate underpayments.

Drake - Federal Tax Payment Service Click the "Make a Federal Tax Payment" button below and you will be directed to the appropriate website that accepts your payment method of choice. PAYMENT METHODS FOR FEDERAL TAXES. Make a Federal Tax Payment Or click one of … Login Screen - Maine File Amended Quarterly Return ... Copies of returns filed on paper must be requested from Maine Revenue Services at (207) 626-8475 or at withholding.tax@maine.gov Reprint Payment Voucher: ... please print out the Internet Payment Voucher and mail it in with your check or money order. If you are unsure whether you are required to remit payments ... Treasury Announces Five Additional Capital Projects Fund Awards to ... Connecticut, Indiana, Nebraska, North Dakota, and Arkansas are approved to receive approximately $408 million under the American Rescue Plan and will connect more than 90,000 homes and businesses to affordable, high-speed internet WASHINGTON — Today, the U.S. Department of the Treasury announced the approval of an additional group of five states under the American Rescue Plan's Coronavirus ... help.taxreliefcenter.org › 941-late-payment-penaltyFailure To Deposit: IRS 941 Late Payment Penalties | Tax ... Sep 10, 2019 · 10% of the amount deposited within 10 days of receipt of an IRS request for payment notice; 15% of the amount not deposited within 10 days of IRS demand for payment receipt; 100% of the un-deposited amount for deliberate remittance negligence (Trust Fund Recovery Recovery Penalty) The IRS expects deposits via electronic funds transfer.

ENB Dividend Yield 2022, Date & History (Enbridge) - MarketBeat When is Enbridge's next dividend payment? Enbridge's next quarterly dividend payment of $0.6680 per share will be made to shareholders on Thursday, September 1, 2022. Individuals | Internal Revenue Service - IRS tax forms September 15. September 1 - December 31. January 15* of the following year. *See January payment in Chapter 2 of Publication 505, Tax Withholding and Estimated Tax. Fiscal Year Taxpayers. If your tax year doesn't begin on January 1, see the special rules for fiscal year taxpayers in Chapter 2 of Publication 505. Farmers and Fishermen. MassTaxConnect Resources | Mass.gov On the upper right-hand side, click on Sign Up or. Under Quick Links, choose Register a New Taxpayer. Tax Department: Contact Center hours are 9 a.m. - 4 p.m., Monday through Friday. (617) 887-6367 or (800) 392-6089 (toll-free in Massachusetts) Visit Contact DOR for more ways to connect with DOR. download.eftps.com › PaymentInstructionBookletPayment Instruction Booklet - EFTPS Payment due on an IRS notice 07301 07307 926 926 12 Return by a U.S. Transferor of Property to a Foreign Corporation Payment due with a return Payment due on an IRS notice 09261 09267 940 940 12 Employer’s Quarterly Federal Tax Return Payment due with a return Payment due on an IRS notice 09405 09401 09404 941 941 03, 06, 09, 12 Employer’s ...

ETRACS Quarterly Pay 1.5x Leveraged Alerian MLP Index ETN the etracs quarterly pay 1.5x leveraged alerian mlp index etn is designed to provide 1.5 times leveraged long exposure to the compounded quarterly performance of the alerian mlp index, less financing costs and tracking fees, and may pay a variable quarterly coupon linked to the leveraged cash distributions associated with the underlying master …

Savings Bonds | Internal Revenue Service - IRS tax forms If your total taxable interest for the year is more than $1500, you must complete Schedule B (Form 1040), Interest and Ordinary Dividends and attach it to your Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors.

Businesses | Internal Revenue Service - IRS tax forms The partners may need to pay estimated tax payments using Form 1040-ES, Estimated Tax for Individuals. As a partner, you can pay the estimated tax by: Crediting an overpayment on your 2021 return to your 2022 estimated tax; Mailing your payment (check or money order) with a payment voucher from Form 1040-ES; Using Direct Pay; Using EFTPS: The ...

IRS Federal Tax Underpayment Penalty & Interest Rates | Intuit IRS interest rates will remain unchanged for the calendar quarter beginning April 1, 2021. The rates will be: 3% for overpayments (2% in the case of a corporation); 3% for underpayments; and; 5% for large corporate underpayments.

NJ Division of Taxation - Sales and Use Tax Forms - State Sales Tax Collection Schedule - 6.875% effective 01/01/2017 through 12/31/2017: Sales and Use Tax: 2017 Jan: ST-75: Sales Tax Collection Schedule - 7% ended on 12/31/2016: Sales and Use Tax: 2006 July: ST-275: Combined Atlantic City Luxury Tax and State Sales Tax Collection Schedule - 3%, 3.625%, 9%, 12.625% effective 1/1/2018: Atlantic ...

ELECTRONIC FEDERAL TAX PAYMENT SYSTEM PAYMENT … Employer’s Quarterly Federal Tax Return Return by a U.S. Transferor of Property to a Foreign Corporation 01–12 01–12 ... Payment due on an IRS notice Payment due with a return Payment due on an IRS notice Payment due on an extension …

Payments | Internal Revenue Service - IRS tax forms 28/05/2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. Service Outages: Check Back Later This service is having outages that may keep you from successfully completing your session. Check back later. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation

directpay.irs.gov › go2paymentIRS Direct Pay Redirect Depending on your income, your payment may be due quarterly, or as calculated on Form 1040-ES, Estimated Tax for Individuals. You do not have to indicate the month or quarter associated with each payment. If you want to make a late estimated tax payment after January 31st (for last year), select Balance Due as the reason for payment.

Form 1099-NEC & Independent Contractors | Internal Revenue Service Use Schedule SE (Form 1040), Self-Employment Tax to figure the tax due. Generally, there's no tax withholding on income you receive as a self-employed individual as long as you provide your taxpayer identification number (TIN) to the payer. However, you may be subject to the requirement to make quarterly estimated tax payments.

Tax Season 2022: What You Need to Know - Ramsey Solutions Tax filing deadline: April 18, 2022, was the big tax deadline for all federal tax returns and payments. Extension deadline : October 17, 2022, is the deadline if you requested an extension. Standard deduction increase : For 2021, the standard deduction increased to $12,550 for single filers and $25,100 for married couples filing jointly.

IRS Publications - TurboTax Tax Tips & Videos A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible. 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.

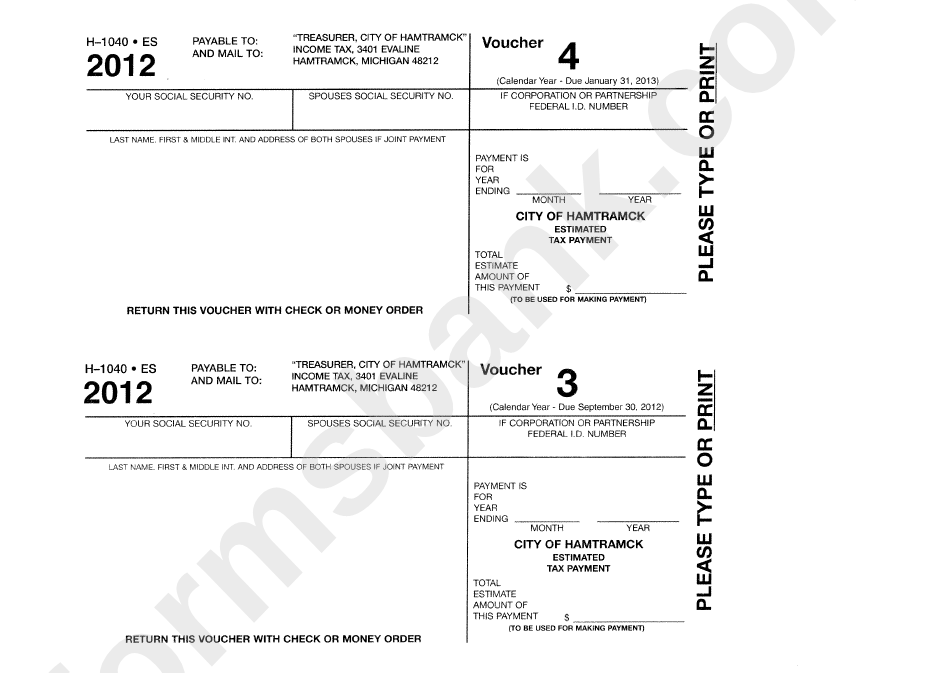

Income Tax Forms | Delaware, OH City of Delaware Income Tax Department P.O. Box 496 Delaware, Ohio 43015. Events. Financial Review Task Force. ... Delaware-2022-Employers-Quarterly-Withholding-Return-Reconciliation* DECLARATION OF ESTIMATED TAX FORM* ESTIMATED TAX PAYMENT VOUCHER* DELAWARE-BUSINESS-FORM-R. DELAWARE-BUSINESS-FORM-R-INSTRUCTIONS.

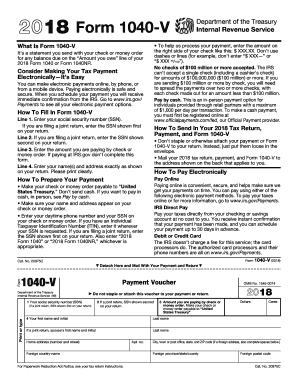

2022 Form 1040-ES - IRS tax forms Go to IRS.gov/Payments to see all your payment options. General Rule In most cases, you must pay estimated tax for 2022 if both of the following apply. 1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits. 2. You expect your withholding and refundable credits

1040paytax.comDrake - Federal Tax Payment Service payUSAtax enables federal taxpayers to pay their individual income taxes and business taxes with a credit card, debit card or Bill Me Later.

Tax Assistance Program - City of Memphis - Memphis, TN Low Income Elderly Homeowners Deadline for payment (without interest and penalty) is August 31, 2022 but deadline for application is October 6, 2022. Must provide 2020 Income for Tax Relief and Tax Freeze Quarterly for: Elderly Homeowners - no income limit. Deadline for application and first payment is August 31, 2022.

FUN Dividend Yield 2022, Date & History (Cedar Fair) - MarketBeat Cedar Fair's most recent quarterly dividend payment of $0.9350 per share was made to shareholders on Tuesday, March 17, 2020. When did Cedar Fair last increase or decrease its dividend? The most recent change in the company's dividend was a decrease of $0.6350 on Wednesday, August 3, 2022.

Selling Stock: How Capital Gains are Taxed - The Motley Fool Cost basis = $100 (10 shares @ $10 each) + $10 (purchase and sale fees @ $5 each) = $110Profits = $150-$110 = $40. So, in this example, you'd pay taxes on the $40 in profits, not the entire $150 ...

File IRS Form 2290 Online for 2022-23 | Schedule 1 in Minutes A. The following information is required for 2290 online filing. It is easy to follow the form 2290 instructions with e file form 2290 filing. You must keep the below 4 key details with you during form to 2290 e-file. EIN - This is a 9-digit Employee Identification Number. Business Name - You can find both Business Name and EIN on the SS-4 ...

Post a Comment for "42 irs quarterly payment coupon"