42 what is the coupon rate

Coupon Rate vs. Interest Rate - What's The Difference (With Table) A coupon rate is defined as the rate which is calculated on the face value of the bond. This implies that it is estimated on the fixed income security that is primarily impacted by interest rates set by the government and that it is usually decided by the issuer of the bonds. What Is Coupon Rate and How Do You Calculate It? - Accounting Services A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually.

› wirecutter › guidesHow to Choose a Mattress for 2022 | Reviews by Wirecutter How to find a mattress you can happily sleep on for years.

What is the coupon rate

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower. Home - Ι ΚΤΕΟ ΚΟΜΒΟΣ ΑΜΑΡΟΥΣΙΟΥ ΑΜΕΣΗ ΕΞΥΠΗΡΕΤΗΣΗ Κλείστε το ραντεβού σας, γρήγορα με ένα τηλεφώνημα στο 210 6101 220 ή με ένα κλικ. ONLINE ΡΑΝΤΕΒΟΥ ΥΠΗΡΕΣΙΕΣ Πλήρης Τεχνικός Έλεγχος Οχήματος ΚΤΕΟ Ι. ΚΤΕΟ ΚΟΜΒΟΣ ΑΜΑΡΟΥΣΙΟΥ Έλεγχος Επιβατικών, Δικύκλων, Ταξί ... What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

What is the coupon rate. › terms › cCoupon Rate Definition Sep 05, 2021 · The coupon rate is the annual income an investor can expect to receive while holding a particular bond. It is fixed when the bond is issued and is calculated by dividing the sum of the annual ... Coupon rate financial definition of Coupon rate - TheFreeDictionary.com Coupon rate. The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons. Ομόλογο - Βικιπαίδεια Επιτόκιο Έκδοσης (coupon rate): Υπάρχουν ομόλογα σταθερού επιτοκίου (fixed rate bond), δηλαδή ομόλογα που πληρώνουν το ίδιο τοκομερίδιο σε όλη την διαρκή της ζωής τους, και ομόλογα μεταβλητού ή ... Coupon Rate of a Bond - WallStreetMojo Coupon Rate is referred to the stated rate of interest on fixed income securities such as bonds. In other words, it is the rate of interest that the bond issuers pay to the bondholders for their investment. It is the periodic rate of interest paid on the bond's face value to its purchasers.

Difference Between Coupon Rate and Discount Rate What is Coupon Rate? Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital. What is 'Coupon Rate' - The Economic Times Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate ... › grocery-breakfast-foods-snacksAmazon.com: Grocery & Gourmet Food Nespresso Capsules VertuoLine, Medium and Dark Roast Coffee, Variety Pack, Stormio, Odacio, Melozio, 30 Count, Brews 7.77 Ounce Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon rate is the interest the bond issuer pays to the bondholder on an annual basis. In other words, it is the return an investor can expect from their bond investment. This article explains the coupon rate for bonds, its calculation, importance and difference between coupon rate and yield to maturity in detail. Scripbox Recommended Goals

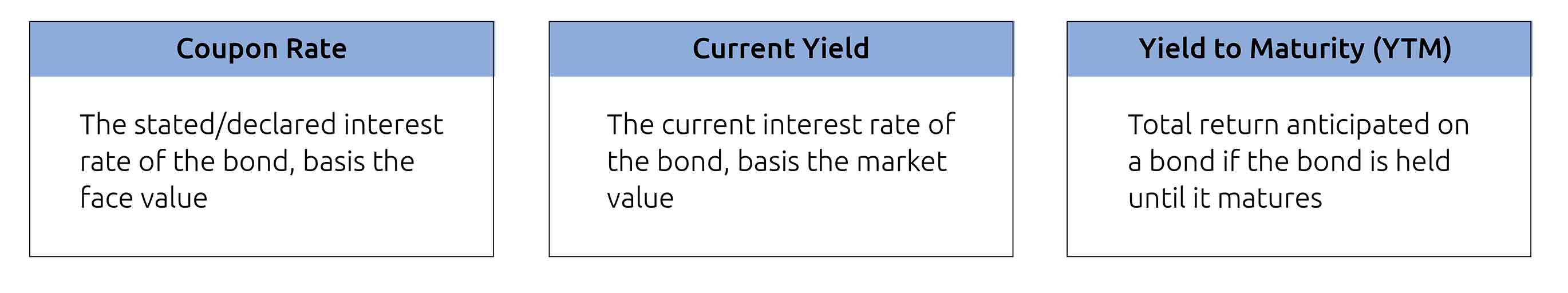

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Τέρνα Ενεργειακή: 6η περίοδος εκτοκισμού κοινού ομολογιακού … 17.10.2022 · Διευκρινίζεται ότι, από την Πέμπτη, 20 Οκτωβρίου 2022 (Ex coupon date) ... These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement Advertisement. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and ... Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate. What Is Coupon Rate and How Do You Calculate It? - SmartAsset Coupon rate, also known as the nominal rate, nominal yield or coupon payment, is a percentage that describes how much is paid by a fixed-income security to the owner of that security during the duration of that bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

What is coupon rate? - Answers Coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's face or par value.Coupon rate can be calculated by dividing the sum of the security's annual coupon ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. 1 A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Coupon Definition - Investopedia A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to...

What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same.

What is coupon rate | Definition and Meaning | Capital.com A coupon rate for a fixed-income security represents an annual coupon payment that the issuer pays according to the bond's par or face value. The coupon payment on a bond is the interest payment received by the holder of the bond until the bond matures. Coupon rate formula The coupon rate calculations formula is simple.

What is a Coupon Rate? - Definition | Meaning | Example Definition: Coupon rate is the stated interest rate on a fixed income security like a bond. In other words, it's the rate of interest that bondholders receive from their investment. It's based on the yield as of the day the bond is issued.

Coupon Rate Formula | Step by Step Calculation (with Examples) In other words, it is the stated rate of interest paid on fixed-income securities, primarily applicable to bonds. The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%

› ask › answersBond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve.

What is the difference coupon rate and yield rate? The coupon rate is the interest rate paid on a bond by the issuer to the holder. It is a percentage of the bond's face value. The yield to maturity is the rate of return an investor will receive if they hold a bond until it matures. This takes into account the coupon payments and any price appreciation or depreciation of the bond.

Coupon Rate: Formula and Bond Calculation (Step-by-Step) - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision As discussed, a coupon rate is a fairly straightforward rate that measures the percentage of interest rate that an investor will receive periodically from the bond issuer. However, the yield to maturity is slightly complicated. To understand yield to maturity, we must be familiar with some characteristics of a bond as follows:

Τέρνα Ενεργειακή: 6η Περίοδος Εκτοκισμού Κοινού Ομολογιακού … 17.10.2022 · Διευκρινίζεται ότι, από την Πέμπτη, 20 Οκτωβρίου 2022 (Ex coupon date) ... These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Advertisement Advertisement. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and ...

Coupon Rate - Explained - The Business Professor, LLC What is a Coupon Rate? A coupon rate refers to the annual interest amount that a bondholder receives usually based on the bonds face value. A coupon rate is the bond interest an issuer pays to a bondholder on its issue date. Any change in the value of the bond changes the yield, a situation that gives yield to maturity of the bond.

Alpha Bank | LinkedIn Alpha Bank | 104,887 followers on LinkedIn. A reliable Group, committed to responsible banking and innovative services for our Customers. Follow Alpha Bank. | The Alpha Bank Group is one of the ...

Coupon Rate - What it is, Formula, & Example - Speck & Company A coupon rate is the percentage value of that cash payment relative to the face value of the bond. For example, say we had a bond with a face value of $1,000 and it paid us an annual coupon of $25. The coupon for this bond would be $25/year while the coupon rate would be $25/$1,000 or 2.5%. The coupon rate is the percentage value.

en.wikipedia.org › wiki › Sales_taxes_in_the_UnitedSales taxes in the United States - Wikipedia The sales tax rate in Larimer County is roughly 7.5%. Most transactions in Denver and the surrounding area are taxed at a total of about 8%. The sales tax rate for non food items in Denver is 7.62%. Food and beverage items total 8.00%, and rental cars total 11.25%. Connecticut

Coupon Rate | Definition | Finance Strategists A coupon rate is the interest attached to a fixed income investment, such as a bond. When bonds are bought by investors, bond issuers are contractually obligated to make periodic interest payments to their bondholders. Interest payments represent the profit made by a bondholder for loaning money to the bond issuer.

What Is Coupon Rate and How Do You Calculate It? A bond's coupon price could be calculated by dividing the sum of the safety's annual coupon payments and dividing them by the bond's par worth. For instance, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with larger coupon rates are extra desirable for ...

Χ.Α + Markets (241): Πολλά μικρά και μεγάλα ενδιαφέροντα (24/10) 24.10.2022 · The bond has a 3-year maturity and is callable in year 2 with a coupon of 7.00% and a yield of 7.25%. The issuance was covered by institutional investors (55%), wealth management (20%), supranational organisations (13%) and asset managers (12%). Following the transaction, MREL pro-forma ratio stands at 19.5% as of 2Q22. The news is neutral and ...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

› ask › answersWhen is a bond's coupon rate and yield to maturity the same? Jan 13, 2022 · The coupon rate of a bond is its interest rate, or the amount of money it pays the bondholder each year, expressed as a percentage of its par value. A bond with a $1,000 par value and coupon rate ...

What Is the Coupon Rate of a Bond? - The Balance A coupon rate is the nominal or stated rate of interest on a fixed income security, like a bond. This is the annual interest rate paid by the bond issuer, based on the bond's face value. These interest payments are usually made semiannually. This article will discuss coupon rates in detail.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

Home - Ι ΚΤΕΟ ΚΟΜΒΟΣ ΑΜΑΡΟΥΣΙΟΥ ΑΜΕΣΗ ΕΞΥΠΗΡΕΤΗΣΗ Κλείστε το ραντεβού σας, γρήγορα με ένα τηλεφώνημα στο 210 6101 220 ή με ένα κλικ. ONLINE ΡΑΝΤΕΒΟΥ ΥΠΗΡΕΣΙΕΣ Πλήρης Τεχνικός Έλεγχος Οχήματος ΚΤΕΟ Ι. ΚΤΕΟ ΚΟΜΒΟΣ ΑΜΑΡΟΥΣΙΟΥ Έλεγχος Επιβατικών, Δικύκλων, Ταξί ...

Coupon Rate Definition & Example | InvestingAnswers In the finance world, the coupon rate is the annual interest paid on the face value of a bond. It is expressed as a percentage. How Does a Coupon Rate Work? The term 'coupon rate' comes from the small detachable coupons attached to bearer bond certificates. The coupons entitled the holder to interest payments from the borrower.

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "42 what is the coupon rate"