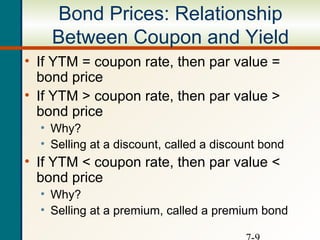

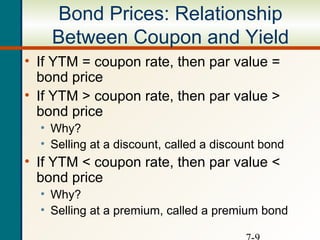

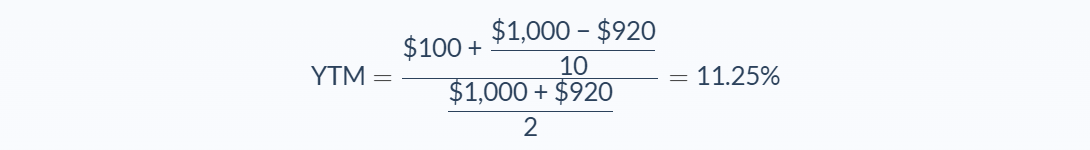

› coupon-bond-formulaHow to Calculate the Price of Coupon Bond? - WallStreetMojo Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). › bond-yield-formulaBond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we must understand that this calculation completely depends on the annual coupon and bond price.

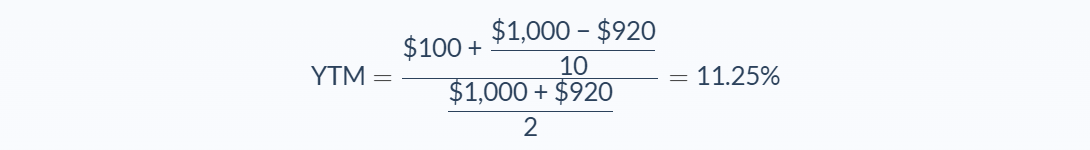

moneychimp.com › articles › finworksBond Yield to Maturity (YTM) Formula - Moneychimp One thing to notice is that the YTM is greater than the current yield, which in turn is greater than the coupon rate. (Current yield is $70/$950 = 7.37%). This will always be true for a bond selling at a discount.

Ytm for coupon bond

› bond-pricing-formulaBond Pricing Formula |How to Calculate Bond Price? - EDUCBA Let’s calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5% and yield is 8%. The maturity of the bond is 10 years Price of bond is calculated using the formula given below

Ytm for coupon bond. › bond-pricing-formulaBond Pricing Formula |How to Calculate Bond Price? - EDUCBA Let’s calculate the price of a Reliance corporate bond which has a par value of Rs 1000 and coupon payment is 5% and yield is 8%. The maturity of the bond is 10 years Price of bond is calculated using the formula given below

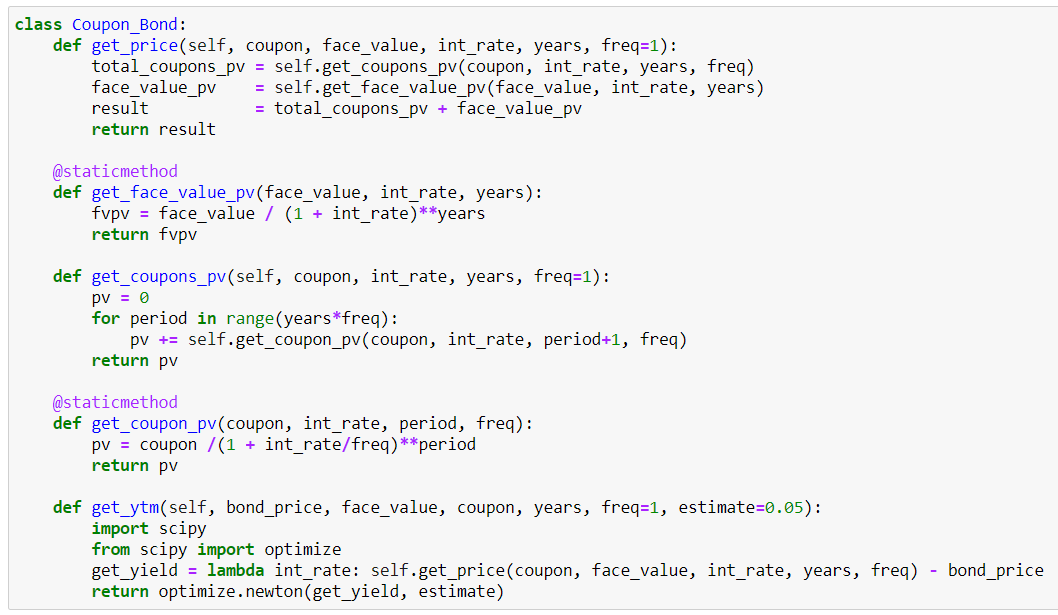

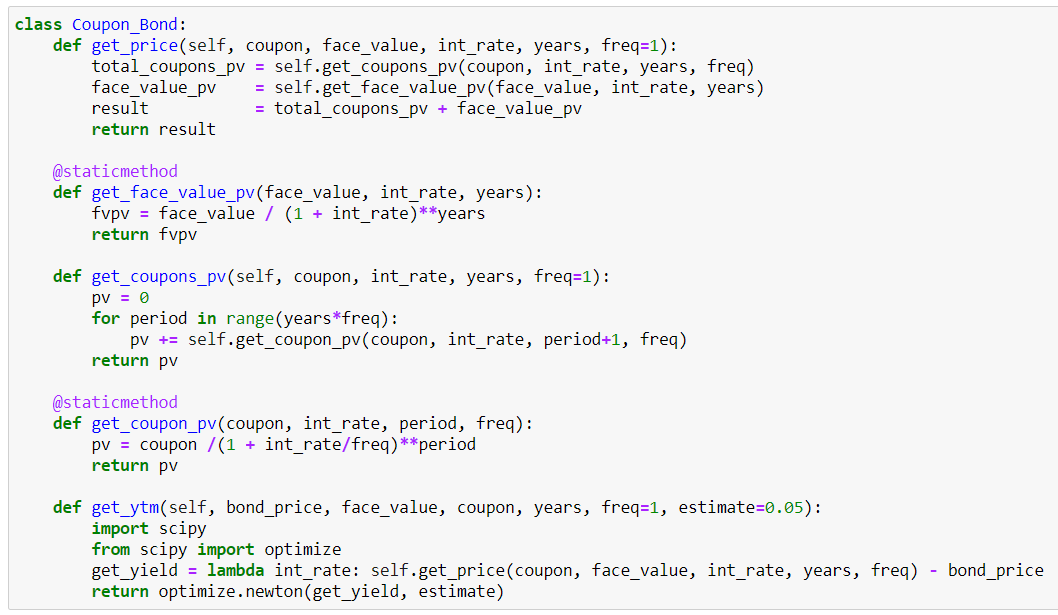

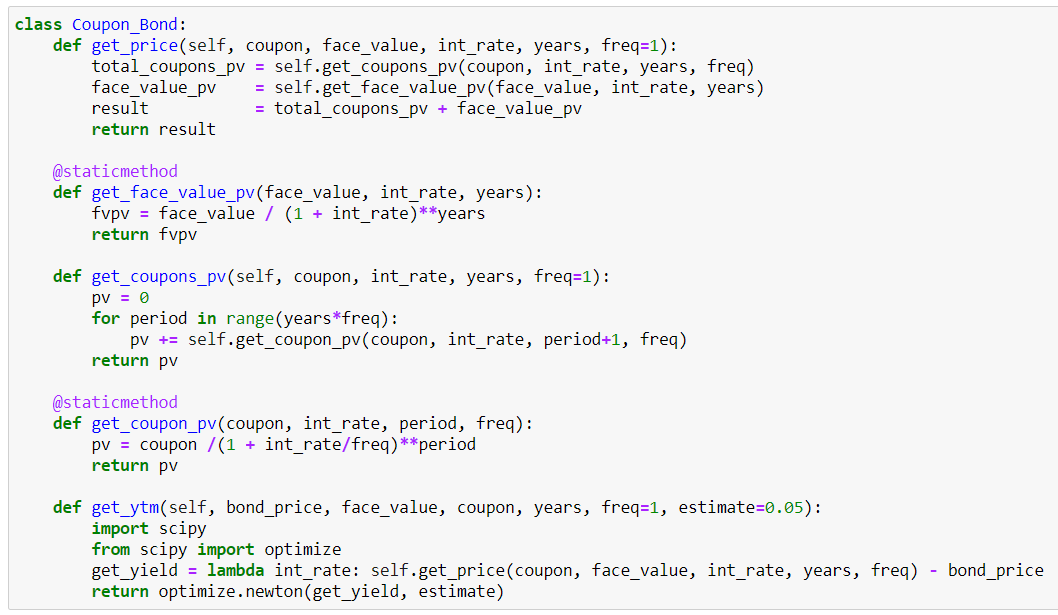

How to calculate Yield To Maturity with Python | by Gennadii ...

What Is Coupon Rate and How Do You Calculate It? | Personal ...

Coupon Bond Formula | How to Calculate the Price of Coupon Bond?

Interest Rates and Bond Evaluation by Junaid Chohan

Solved The yield to maturity on 1-year zero-coupon bonds is ...

Yield to Maturity – What it is, Use, & Formula – Speck & Company

Coupon Bond Formula | Examples with Excel Template

![Solved] The yield to maturity on 1 year zero coupon bonds is ...](https://www.coursehero.com/qa/attachment/20019199/)

Solved] The yield to maturity on 1 year zero coupon bonds is ...

What is Bond - Meaning, Types & YTM Calculation Process

CHAPTER 8

Yield to Maturity - Principles of Finance - Solved Questions ...

:max_bytes(150000):strip_icc()/ytm_ex_2-5bfd887c4cedfd0026004e57)

Learn to Calculate Yield to Maturity in MS Excel

Yield to Maturity | Formula, Examples, Conclusion, Calculator

MGT338 - Chapter 6: Valuing Bonds | Team Study

How can I calculate the present value of a bond using YTM ...

Stata codes for calculating yield to maturity for coupon ...

Calculating the Yield to Maturity (YTM) of a Bond | Financial ...

Solutions to Chapter 6 Valuing Bonds 1. a. Coupon rate = 6 ...

Coupon Rate and Yield to Maturity | How to Calculate Coupon Rate

Chapter 10 Bond Prices and Yields 4/19/ ppt download

Coupon Rate - Meaning, Example, Types | Yield to Maturity ...

Zero Coupon Bonds - Financial Edge

/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

Yield to Maturity (YTM): What It Is, Why It Matters, Formula

What is the difference between Coupon Rate and Yield to ...

Yield to Maturity | Components and Examples of Yield to Maturity

YIELDS TO MATURITY ON ZERO-COUPON RONDS

Yield to maturity - Fixed income

Zero Coupon Bond Price Calculator Excel (5 Suitable Examples)

Calculating the Yield of a Coupon Bond using Excel

Yield to Maturity - Approximate Formula (with Calculator)

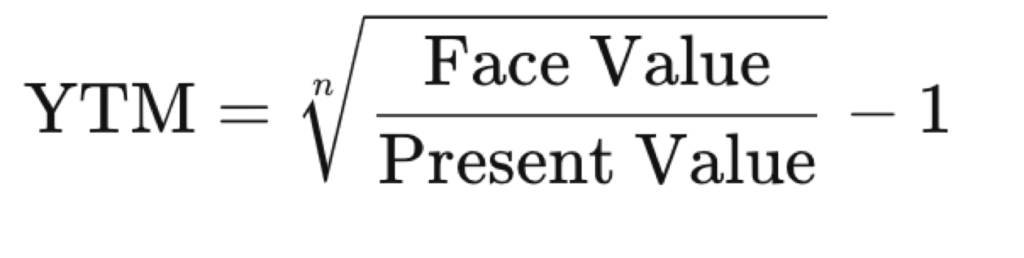

Calculate the YTM of a Zero Coupon Bond

What is the YTM on a 10-year, 9% annual coupon, $1,000 par ...

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Yield to Worst (YTW): What It Is and the Formula to Calculate It

Yield to Maturity – What it is, Use, & Formula – Speck & Company

Yield to Maturity (YTM): Formula and Calculator (Step-by-Step)

Zero Coupon Bond Price Calculator Excel (5 Suitable Examples)

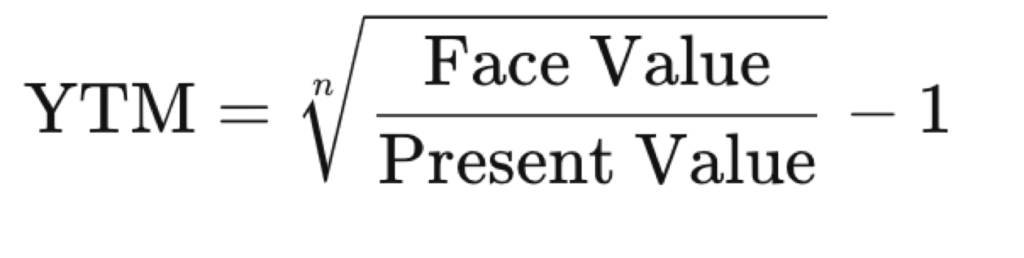

Zero-Coupon Bond Yield To Maturity (YTM)

Coupon Bond Formula | How to Calculate the Price of Coupon Bond?

Yield to Maturity (YTM) - Meaning, Formula & Calculation

Yield to Maturity

Yield To Maturity(YTM): Meaning & Coupon Rate Vs YTM Vs ...

How to Calculate the Yield of a Zero Coupon Bond Using ...

Consider a coupon bond that has a 900 par value and a coupon rate of 6 %. The bond is currently selling for 860.15 and has two years to maturity. What is the bond's yield to maturity (YTM)?

How Do I Calculate Yield To Maturity Of A Zero Coupon Bond?

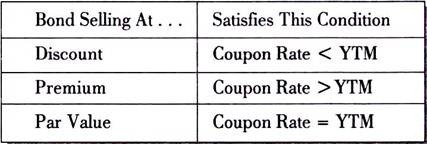

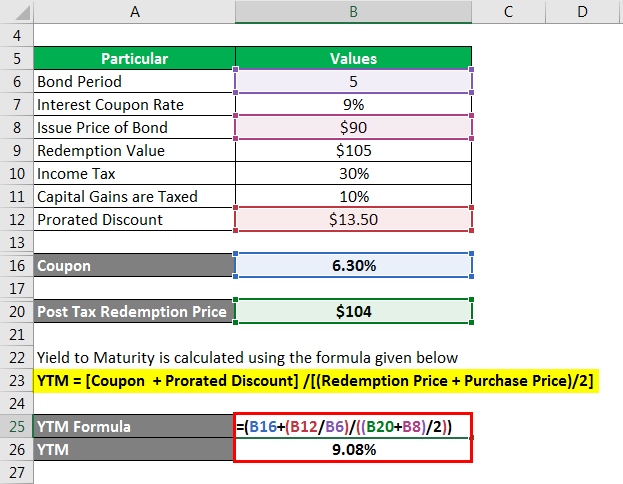

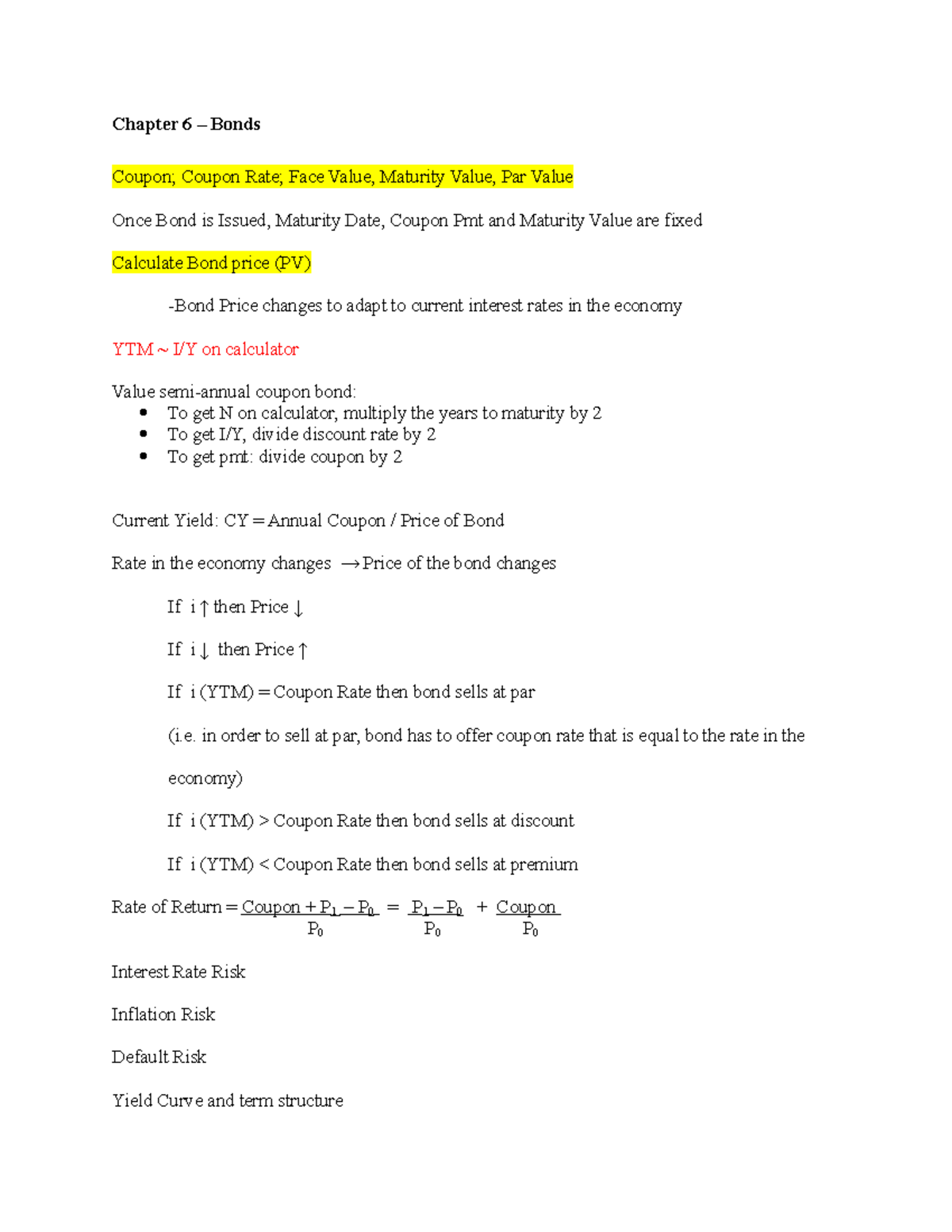

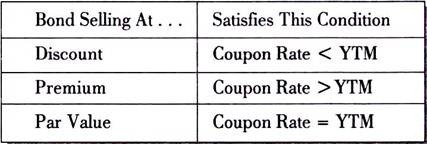

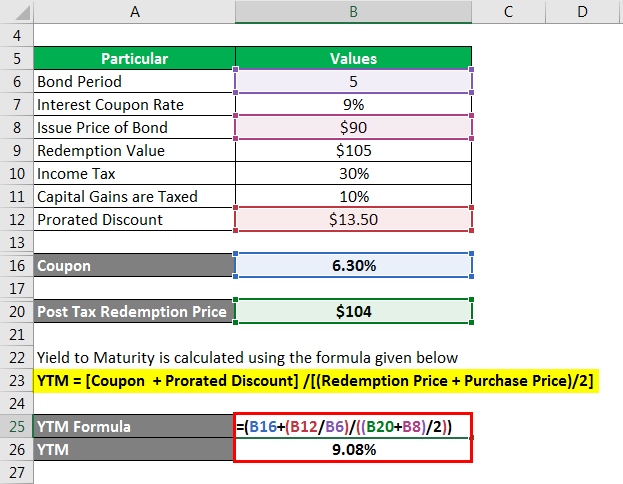

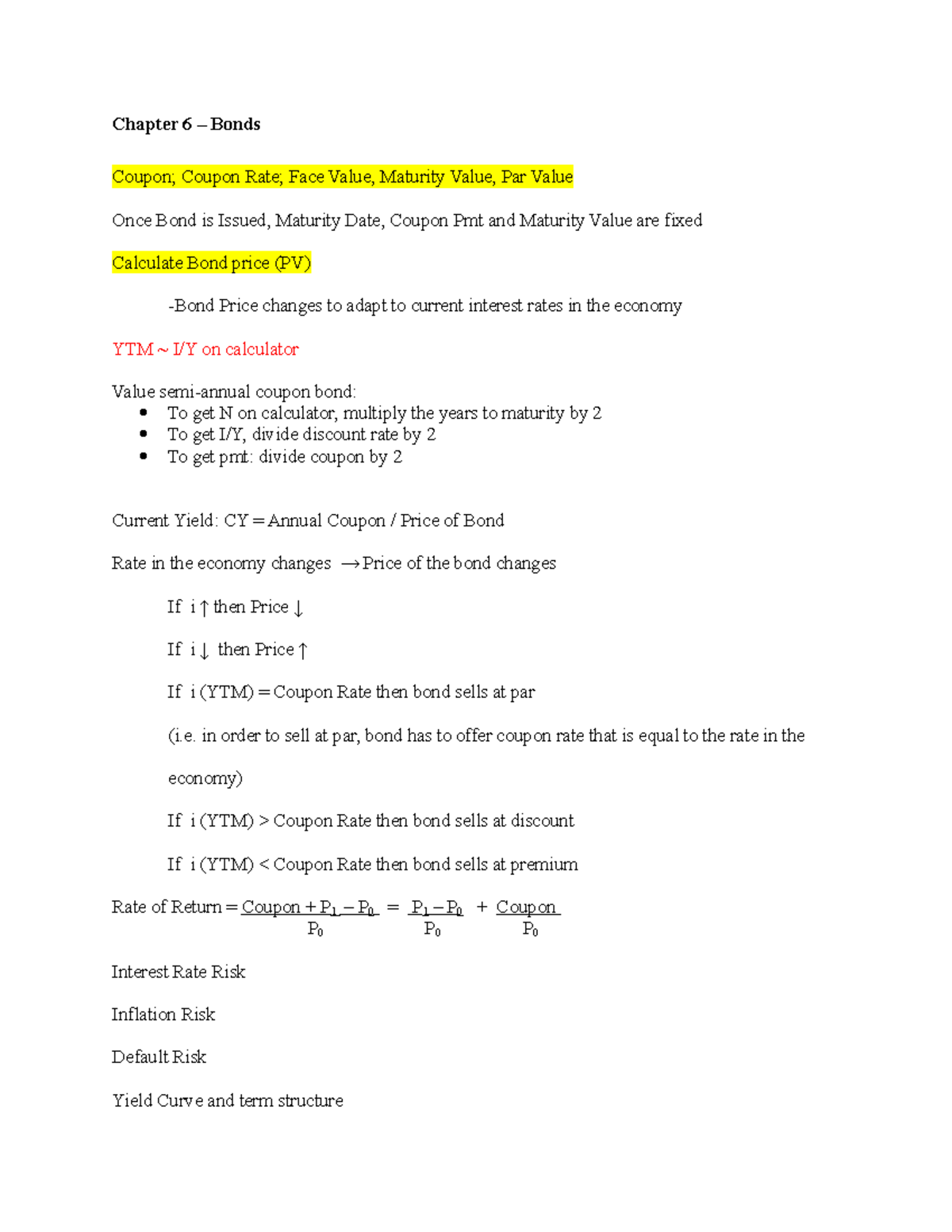

Review Topics for Exam 2 - Chapter 6 – Bonds Coupon; Coupon ...

/Term-Definitions_yieldtomaturity_FINAL-bbbebc60d39345e9b5be26e89e8cb62f.png)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "45 ytm for coupon bond"