43 formula for coupon rate

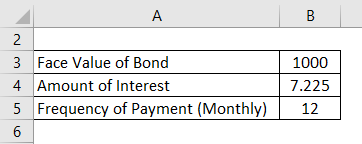

Current Yield Formula | Calculator (Examples with Excel Template) Step 1: Firstly, determine the annual cash flow to be generated by the bond based on its coupon rate, par value, and frequency of payment. Step 2: Next, determine the current market price of the bond based on its own coupon rate vis-à-vis the ongoing yield offered by other bonds in the market. Based on the fact that whether its coupon rate is ... Predetermined Overhead Rate Formula | Calculator (with Excel ... The formula for the predetermined overhead rate can be derived by using the following steps: Step 1: Firstly, determine the level of activity or the volume of production in the upcoming period. Step 2: Next, determine the estimated manufacturing overhead cost for that level of activity in the forthcoming period.

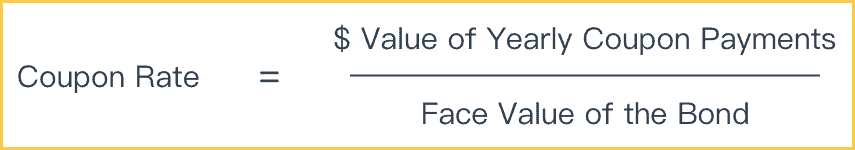

Coupon Rate Formula | Step by Step Calculation (with Examples) The coupon Rate Formula is used to calculate the coupon rate of the bond, and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments by the par value of the bonds and multiplying the resultant with the 100.

Formula for coupon rate

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. Effective Interest Rate Formula | Calculator (With Excel ... Effective Interest Rate = (1 + 10%/2) 2 – 1 Effective Interest Rate = 10.25% Therefore, the effective interest rate for the quoted investment is 10.25%. Effective Interest Rate Formula– Example #2 Coupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments.

Formula for coupon rate. Effective Tax Rate Formula | Calculator (Excel Template) - EDUCBA Effective Tax Rate Formula In a very simple language, the effective tax rate is the average rate of tax at which the income of a corporation or an individual is taxed. In the case of an individual, it can be calculated by taking a ratio of total tax expenses and taxable income and for corporations, it is calculated by dividing total income tax ... Coupon Rate of a Bond (Formula, Definition) | Calculate ... Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples Let us take the example of a bond with quarterly coupon payments. Effective Interest Rate Formula | Calculator (With Excel ... Effective Interest Rate = (1 + 10%/2) 2 – 1 Effective Interest Rate = 10.25% Therefore, the effective interest rate for the quoted investment is 10.25%. Effective Interest Rate Formula– Example #2 Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg.

Post a Comment for "43 formula for coupon rate"